The complete deal management platform for M&A professionals. Manage data rooms, track Q&A, automate workflows, and close deals faster.

Secure virtual data rooms with granular access controls per target. Track document views, downloads, and uploads with complete audit trails. Organize files with folder hierarchies and drag-and-drop simplicity.

Manage due diligence Q&A sessions with bidirectional communication. Both deal teams and participants can ask questions. Track status, set deadlines, and control visibility with approval workflows.

Manage multiple targets per deal with custom fields and process steps. Track engagement status, contacts, and progress through each stage. Link to your Universe company database.

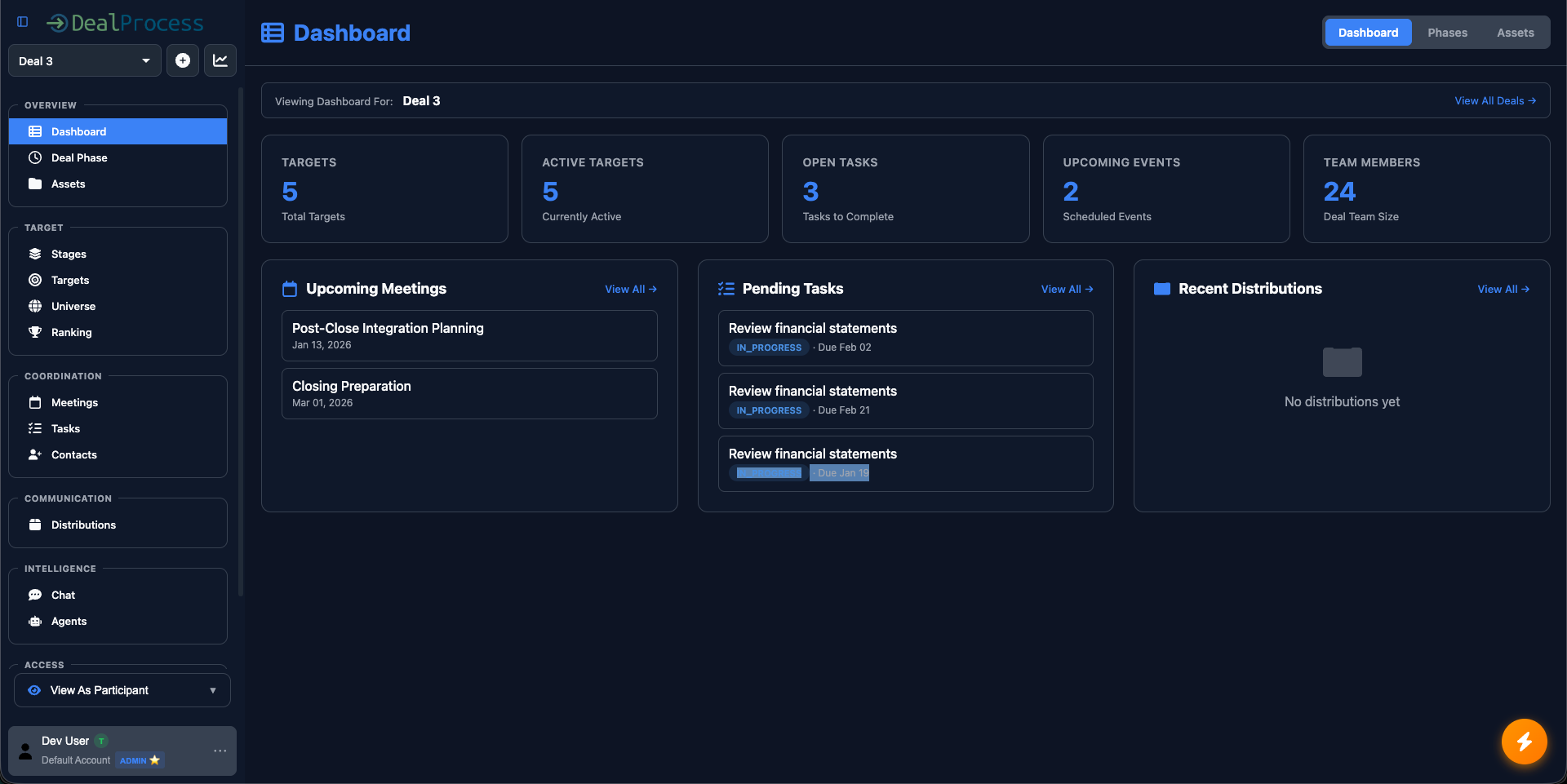

Kanban-style task management with priorities, assignments, and due dates. Create due diligence checklists by category. Track completion progress per target with granular permissions.

Evaluate and rank bids from IOI through binding offers. Score offers, track financial terms, and compare bidders side-by-side. Manage the entire bid process from first indication to final acceptance.

Chat with AI powered by your deal documents. Semantic search across data rooms with RAG integration. Multiple LLM providers supported including Claude, GPT-4, and Gemini.

Build custom automation workflows with visual designer. Set up triggers for emails, webhooks, or schedules. Chain steps with conditionals, loops, and OAuth integrations to Google and more.

Create and distribute document packages with version control. Track who received what version. Manage NDAs, CIMs, process letters, and bid instructions in organized distributions.

Role-based access control with per-app permissions. Control visibility by deal stage. Admin "view as participant" mode for testing. Complete audit logging of all permission changes.

Streamline your transaction process and close deals faster with purpose-built tools for M&A professionals.

Manage sell-side and buy-side processes with custom deal pages for each mandate. Track multiple bidders, coordinate due diligence, and manage timelines efficiently.

Streamline deal sourcing and execution. Organize target pipelines, manage LOI processes, and coordinate with portfolio companies throughout the transaction lifecycle.

Manage strategic acquisitions and divestitures with centralized documentation, Q&A tracking, and stakeholder coordination across internal teams and external advisors.

Coordinate transaction documentation, manage NDAs, track regulatory filings, and maintain secure communication channels with all deal parties.

Have questions or want to learn more? Fill out the form and our team will get back to you shortly.

Get in touch with our team to schedule a demo and receive a customized quote tailored to your needs.